Updated on Wednesday, Feb. 8, 2023 at 4:45 p.m.

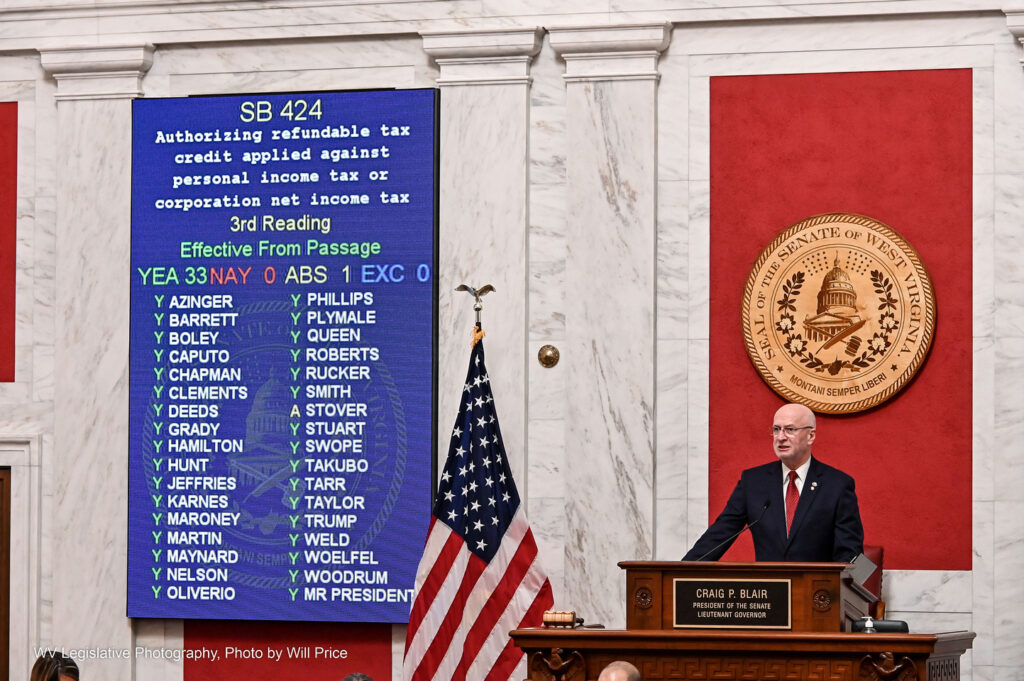

The Senate gaveled back in right at 4 p.m. to discuss Senate Bill 424, which includes the proposed tax cuts. The Senate suspended its own rules to advance the bill to third reading and complete action on the legislation.

A number of senators – including all three Democrats – rose to voice their support, and the bill passed unanimously. It now goes to the House of Delegates for their consideration.

Original Post:

Senate Republicans gathered in front of the Senate chamber Wednesday morning to present their tax reduction plan for West Virginia.

“What we believe we’ve put together is a very comprehensive, safe tax reduction plan that is as wide as we could possibly make it to capture and help the vast majority of West Virginians across the state of West Virginia,” said Senate Majority Leader Sen. Tom Takubo, R-Kanawha. “What we want to do now is try to be able to give some tax relief back to the West Virginians across the state, but we want to do so in a way that we don’t overspend, that we don’t overstep, and kind of get out in front of our skis and then get in a situation where we hurt anybody.”

The plan would reduce personal income tax by 15 percent across the board next year, and continue reducing personal income tax in the years to come.

“There’s a trigger that as our economy grows here in West Virginia, it further brings down the income tax all the way to zero,” said Senate Finance Chair Sen. Eric Tarr, R-Putnam.

The plan is a departure from Gov. Jim Justice’s plan to reduce personal income tax by 50 percent over the next three years, starting with a 30 percent cut. The House of Delegates approved the governor’s plan weeks ago, but Senate leaders called it “dead on arrival” before it ever reached their chamber.

Tarr clarified that the personal income tax would continue to decrease as the economy grew.

“When our sales tax collections, without ever raising a sales tax, increase 105 percent over the previous year, it triggers a dollar for dollar reduction of that amount of increase,” Tarr said. “If it’s 107 percent, then it’s going to be 7 percent that triggers it down. If it’s less than 105 [percent], there’s no trigger. It creates a smoothing mechanism to safely bring down our income tax to zero.”

The Senate’s tax reduction plan also includes a rebate for the payment of taxes on vehicles, reminiscent of the proposal in Amendment 2 that was voted down in November 2022. Takubo said the vehicle tax rebate would ensure low income households, and those on fixed income, also benefited.

“Regardless if you’re low income or regardless of your fixed income, you usually got to have a vehicle to get around, and we’re gonna give that back in a rebate so that that they also can benefit from this comprehensive tax plan,” Takubo said.

Similarly, the plan would give a homestead real property tax rebate for some service-disabled military veterans, as well as eliminate the West Virginia tax filing “marriage penalty.”

“Many West Virginians don’t realize that the tax code in West Virginia actually helps those that are single and not married couples, and that’s not what West Virginia values are about,” Takubo said. “We should be promoting and helping those financially that want to build a family and have that family unit. So this will eliminate that penalty in our tax code.”

The plan is not limited to personal income, and promises a 50 percent rebate for the payment of equipment and inventory taxes paid by West Virginia small businesses. Tarr said the legislators had heard criticism of a similar action during their push for Amendment 2, and now limited the rebate to small businesses only.

“What this bill does, it does not include corporate net,” Tarr said. “It’s your pass through entities, it’s your sole proprietors, it’s the small businesses of West Virginia. This does not affect the corporate net income tax, which would have included those big boxes.”

Takubo said Senate leadership has been speaking with Justice throughout the session, and believe their plan achieves his goals of, “helping the small folks, the small businesses, those that are less fortunate in the state,” but are still waiting for comment on the plan.

Senate President Craig Blair, R-Berkeley, said he has reached out to House Speaker Roger Hanshaw, R-Clay, to let him know what’s happening.

“We’re family here,” Blair said. “We’ve been working back and forth for over a month long.”

He concluded by saying the Senate is ready to move quickly to get the plan into the House of Delegates as soon as possible.

“One of the goals is to be able to finish this legislation and have it moved into the House of Delegates before day 30,” Blair said. “Today’s day 29. Our goal was to be able to move this on through and get it done. We’ve been working for over a month.”

The Senate plans on reconvening a split session Wednesday evening at 4 p.m. to ensure the plan is passed through the chamber.

Governor’s Reaction

Shortly after the Senate’s announcement, Gov. Justice held his own press conference to give an administrative update. He praised the Senate and Blair for their proposal.

“We’ve got to get everybody on board and get to a compromise or get to a solution here, but we really thank [Blair] and thank all the senators that jumped on board and really tried to help and everything,” Justice said. “Now we’re on a pathway to put real meaningful money right back into people’s pockets, and I know you’ll do the right thing with it.”

In response to questions, Justice said he needs to look at the details of the plan before commenting further. He continued to compliment the Senate’s plan, while also giving credit to the House of Delegates.

“The House, absolutely, we should give so much respect to the House,” Justice said. “We have not done this kind of stuff since 1987. We have finally, finally got this state really moving in a great, great, great way. What we want to do is we want to pull the rug together.”

When asked about the small business rebate, a different version of which Justice focused on in his campaign against Amendment 2, he said the Senate’s changes addressed his concerns.

“In this situation now, the counties will remain whole. That is really, really, really good,” Justice said. “If there’s a way to move forward and be able to do things for our small businesses and be able to move forward and do things for the possibility of additional manufacturing or whatever coming to our state, I don’t think anybody in the world is turning their nose up at anything about that.”

Justice will meet with legislative leaders Thursday morning to further discuss the various plans for the state’s taxes.

*Editor’s note: This story was updated to include Justice’s reaction to the Senate announcement.