Members of the West Virginia House of Delegates are taking steps to address “unethical telemarketing practices,” but have not found consensus over the best approach to the issue.

House Bill 3169 would expand limitations on insurance-related marketing calls from “unlicensed persons” in an attempt to clamp down on insurance-related telemarketing scams.

Under current state law, individuals who are not licensed to sell insurance can refer customers to insurance products or providers only if they receive “no fee or only a nominal fee” of $100 or less. In other words, residents cannot contact others to promote insurance services without permission if they have a financial interest in doing so.

The proposed bill would expand that policy by requiring telemarketers contacting residents about insurance services do not, without permission, use “autodialed, prerecorded or artificial voice” messages. Telemarketers would also be barred from contacting residents on the Federal Communications Commission’s National Do Not Call Registry or misrepresent their identity or qualifications.

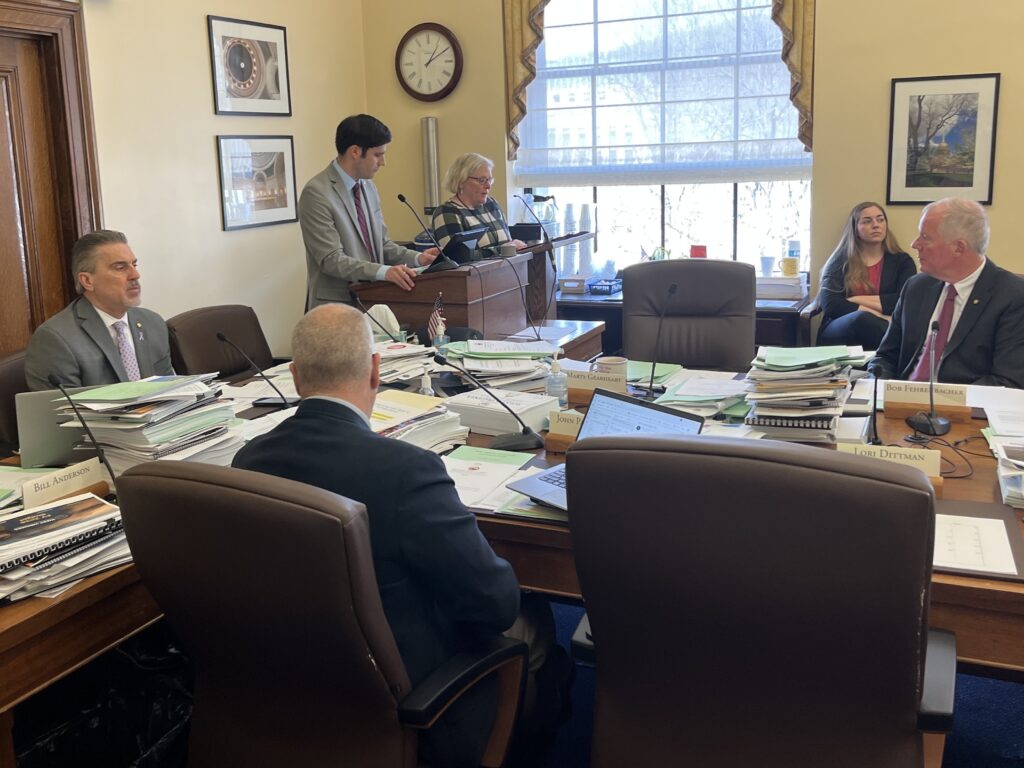

Del. Bob Fehrenbacher, R-Wood, is the bill’s lead sponsor. During a meeting of the House Subcommittee on Banking and Insurance Wednesday afternoon, he described the bill as a step toward addressing a far-reaching problem.

“I feel that there is the potential for this to reduce, but frankly not eliminate, these robocalls, and the abuses that these solicitors perform on our citizens,” Fehrenbacher said.

During the subcommittee meeting, Del. Daniel Linville, R-Cabell, pushed back on the efficacy of the bill. He said its specifications are already covered by federal and state law.

“The things this bill purports to ban are already illegal,” Linville said, pointing to bans for telemarketers using autodial or contacting participants in the National Do Not Call Registry. Both of these practices are prohibited federally under the Telephone Consumer Protection Act of 1991.

“I don’t understand the need for this bill in the least,” Linville said. “I’m not sure it does anything.”

Linville also described telemarketing issues as “a matter of enforcement,” and said telemarketing scams persist regardless of the particular provisions of policies like House Bill 3169.

“I mean, we can assign the death penalty to this and it still wouldn’t matter. The technology is not there to prove it,” he said. “… This bill wants us to feel good about voting on it without changing anything that’s happening.”

Fehrenbacher said he understood Linville’s concerns, and agreed that “fraudulent performers of these solicitations” would be willing to evade state and federal laws to carry out their telemarketing practices.

But Fehrenbacher said the bill would tighten policies for legitimate referrals, and “organizations who have been asked to do this for legitimate insurance purveyors or providers.”

“What this should and hopefully would do is have those insurance providers require that those solicitors or referrals comply with these agreements, as opposed to a kind of carte blanche, unfettered, unlicensed approach,” he said.

Despite Linville’s pushback, the subcommittee voted to advance House Bill 3169 by a verbal majority vote. The bill now advances to the House Finance Committee for further deliberation.