Indications that Senate, House and Executive branch leadership were working toward a tax reform compromise got a shake up on the House floor Wednesday.

A state Tax and Revenue Department fiscal note on the Senate tax reform plan indicated a total cost of around $740 million dollars instead of the $600 million Senate projected cost. The note also mentions several problematic references, definitions and other inconsistencies in the bill wording and methodology.

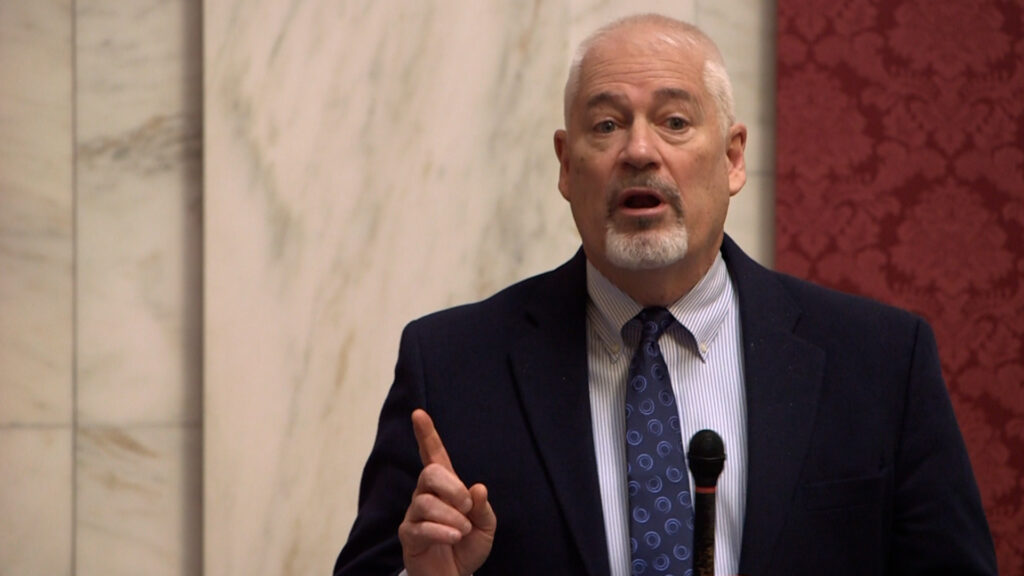

House Finance Committee member, Del. Larry Rowe, D-Kanawha, was troubled by the fiscal note.

“Basically, it would be to fund what was in Amendment 2 that was on the ballot and that the governor opposed,” Rowe said. “The bill ran in six hours. I’ve never seen that in my life, six hours from introduction to sending it to the House with this rule suspension. It came very fast. It’s also got some problems in the writing of the bill.”

Del. Marty Gearheart, R-Mercer, said that he’s not prepared to endorse a Senate plan containing property tax relief elements similar to the failed Amendment 2, such as a 50 percent equipment and inventory property tax cut for West Virginia small businesses.

“It doesn’t mean I’m not confused and maybe a little upset that we can’t get past the fact that something that we placed on the ballot, something that I supported and voted for,” Gearheart said. “However, it didn’t pass. We’ve got two and a half weeks to provide relief to West Virginians. We’ve got two and a half weeks to see to it that they pay less tax. Beyond my confusion, let’s find a way to get it done.”

Rowe said the slow-moving tax reform issue is holding up other things lawmakers need to do, like funding $85 million for passed safe schools legislation – to change the security entries at schools statewide