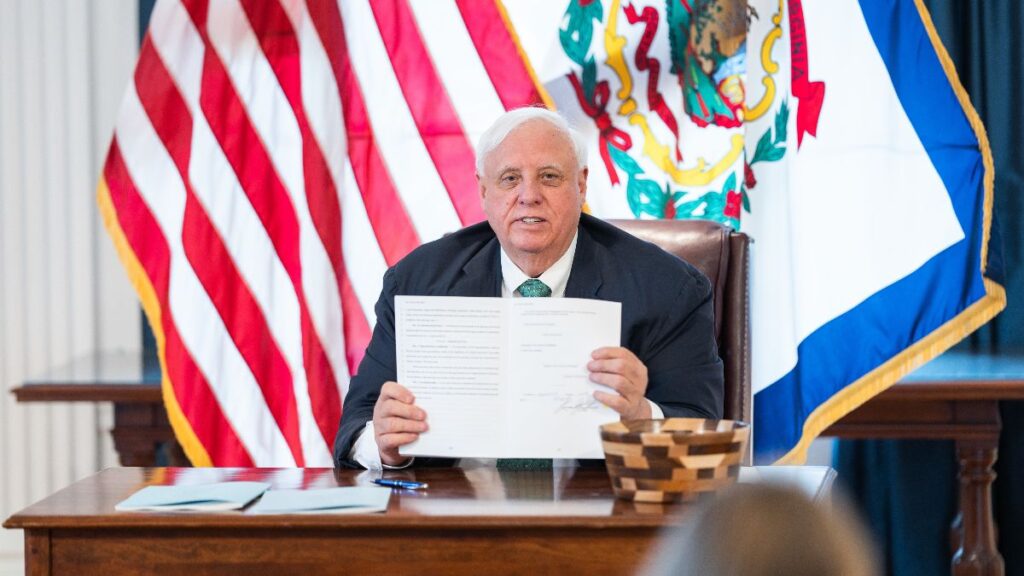

In a Wednesday media briefing, Gov. Jim Justice and Revenue Secretary Dave Hardy defined, and added to, earlier released details on how the state will spend some of its more than $1.8 billion budget surplus.

Hardy said a little over $1.1 billion is designated as surplus section spending. He said that covers 32 different 2023 budget items passed by the legislature and signed by the governor.

He said $40 million goes to the School Building Authority to cover the inflationary rise of school building costs, and $125 million toward the construction of a new consolidated state laboratory.

“Our state laboratories are deficient,” Hardy said. “Our state police, our health department and our agricultural secretary have all stated that our laboratories are ancient and obsolete.”

Hardy made note that another $282 million is set aside for deferred maintenance for state colleges, universities and correctional facilities.

“This is taking the benefit of the surplus and applying it to deferred maintenance, that’s gone on sometimes 20 or 30 years that it’s been neglected,” he said.

Hardy said $400 million goes to the personal income tax reserve fund, to pay income tax refunds as they come due. Other items include a one-time $50 million payment to the West Virginia University Cancer Institute and $29 million to the West Virginia School of Osteopathic Medicine in Lewisburg.

“The surplus section has become the way that we take the benefit of holding down our expenses, holding down our base budget, waiting till the fiscal year is over and then allocating dollars toward unmet needs,” Hardy said.

Find a more detailed listing of Fiscal Year 2023 surplus section spending here.