On Saturday, the House of Delegates met in an extended session and took up several major bills.

This was an effort to shore up the Public Employees Insurance Agency (PEIA). Recently, hospitals and providers have announced they would stop accepting the insurance plan. To fix it, Senate Bill 268 would require a minimum 110 percent reimbursement of the Medicare rate for all providers.

On the other hand, it would increase employee premiums by roughly 25 percent. Spouses who have insurance available through their own employers would have to pay an additional $147 a month to stay on the plan. No coverage would change, including for out-of-state services, and no retirees would be affected.

Del. Larry Rowe, D-Kanawha, in speaking to a rejected amendment to the PEIA bill, asked about Gov. Jim Justice’s rainy day fund for PEIA.

“But the governor said in the State of the State that he proposed to have $100 million put into it, the rainy day fund for PEIA,” Rowe said. “Well, what does that do? Well, it allows us to step in any increases we want to do so that it’s not disruptive to families, very important.”

The program had a projected $154 million deficit for Fiscal Year 2024.

Senate Bill 268 passed the House after nearly three hours of discussion by 20 delegates.

The Senate passed the bill by a vote of 26 to 6 Monday.

The House also approved its own version of a 2024 budget – reducing the governor’s proposal by about $250 million to account for other priorities.

The House budget adds $800,000 for after-school programs, $77 million in support for families as directed through House Bill 2002 and $842 million to develop the foster care portal as set forth in House Bill 2538.

Additional funds were added in the House budget for the Community and Technical College System and the Learn and Earn program established through House Bill 3417, the newly created Woody Williams State Military Funeral Honor Guard fund and the uniform allowance for members of the National Guard.

The House unanimously approved an amended Senate Bill 423, which would increase the annual salaries of members of the West Virginia State Police, and public-school teachers by $2,300. The pay raises would become effective July 1.

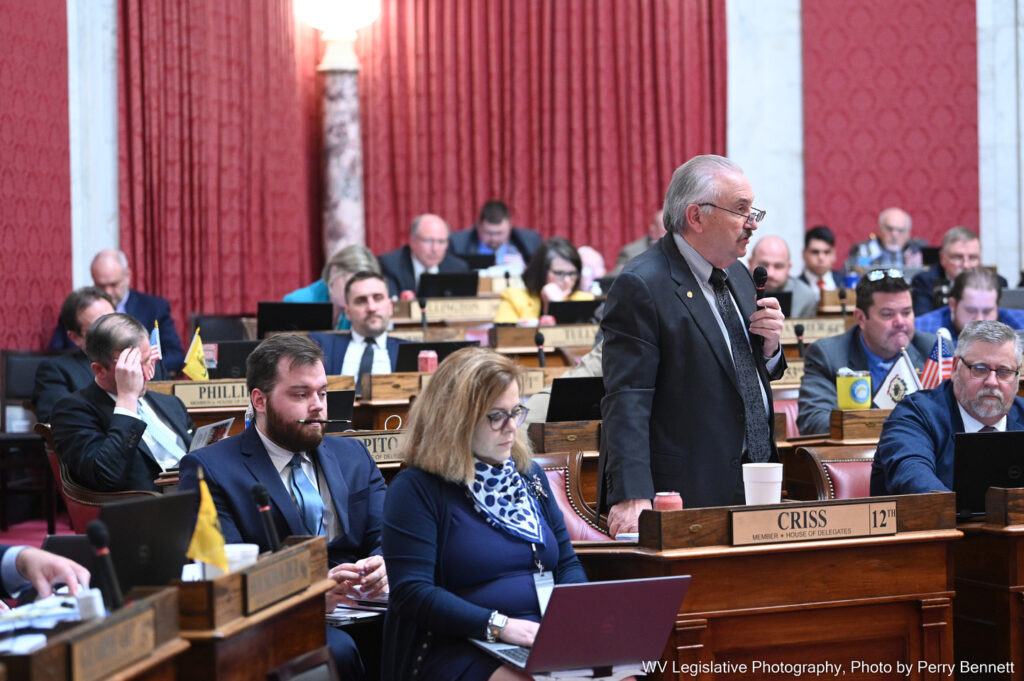

House Finance Chairman Vernon Criss, R-Wood, explained the bill.

“The salary schedule set forth in this statute is as follows: For professional educators and professional students, support personnel, collectively teachers $2,300 an increase in annual pay, based on a 200 day per year contract for public school service personnel $230 slashed to $115 increase on monthly pay. Note the $230/$115 difference because their service personnel contract is to work more than three and a half hours a day. The raise is $230 a month, others for three and a half hours or less is $115 a month. For members of the State Police and certain civil forensic lab personnel, $2,300 annual pay,” Criss said. “Unlike in prior years where the pay raise for Education State Employees, we’re effectively giving across the board pay raise approximately a 5 percent on the average of the respective group in aggregate salaries. Likewise, the state police were given an across the board pay raise equal to approximately 5 percent. On average, across state, employee aggregate salaries except last year when the state police got a 10 percent per raise. This provides for a $2,300 per year pay raise for all of them. All salary increases in this bill become effective July 1, 2023. I urge passage.”

The Senate approved the amendment unanimously and the bill is on the way to the governor.

The House approved House Bill 2526, agreeing with the Senate’s proposals to reduce the personal income tax. HB 2526 represents a $754 million cut in taxes.

“This is a slam dunk,” Del. Daniel Linville, R-Cabell, said. “This is an absolute complete and total slam dunk. The people of this state are taxed enough, already. Let’s lower their taxes. This makes sure that every single income bracket for PEIA, even if you pay the additional money for your spouse, and you’ve got the additional current increases to bring us up to inflation, not one person will have a net loss of earnings, not one person. Let’s keep that promise.”

Personal income tax rates would be cut by 21.25 percent across all six tax brackets, retroactive to Jan. 1, 2023. Additional personal income tax reductions would be limited to no more than 10 percent at any given time, but a formula would activate additional tax cuts when surplus allows.

Taxpayers would receive a 100 percent tax credit on their vehicles when they pay personal property taxes, and small businesses would be able to claim a 50 percent refundable tax credit against personal income taxes or the taxes paid on machinery, equipment and inventory.

“We’re standing here at the threshold of what I would call generational tax cuts, things that are going to mean a big deal to our constituents back home,” said Del. Trenton Barnhart, R-Pleasants. “However, while I believe in that bill, one thing I believe in more is a general principle, and that is to reduce the tax burden on the people that state and that’s what we have the opportunity to do. We need to concur on this need to move on and everybody gets something that they can agree with. And everybody got part of what they wanted. And we’re going to help the people of West Virginia.”

Disabled military service veterans would receive a refundable tax credit against their personal income taxes for real property taxes paid on their homes.

HB 2526 now goes to the governor for a signature.