Cecil Roberts will step down as president of the United Mine Workers of America in October.

He says that in his 30 years at the head of the union, no achievement was more important than saving the health care and pensions of tens of thousands of retired coal miners.

Roberts spoke last week with Curtis Tate about that effort and his coming retirement.

Tate: I’m just wondering if you have any reflections on that, any thoughts about that effort and the folks who participated?

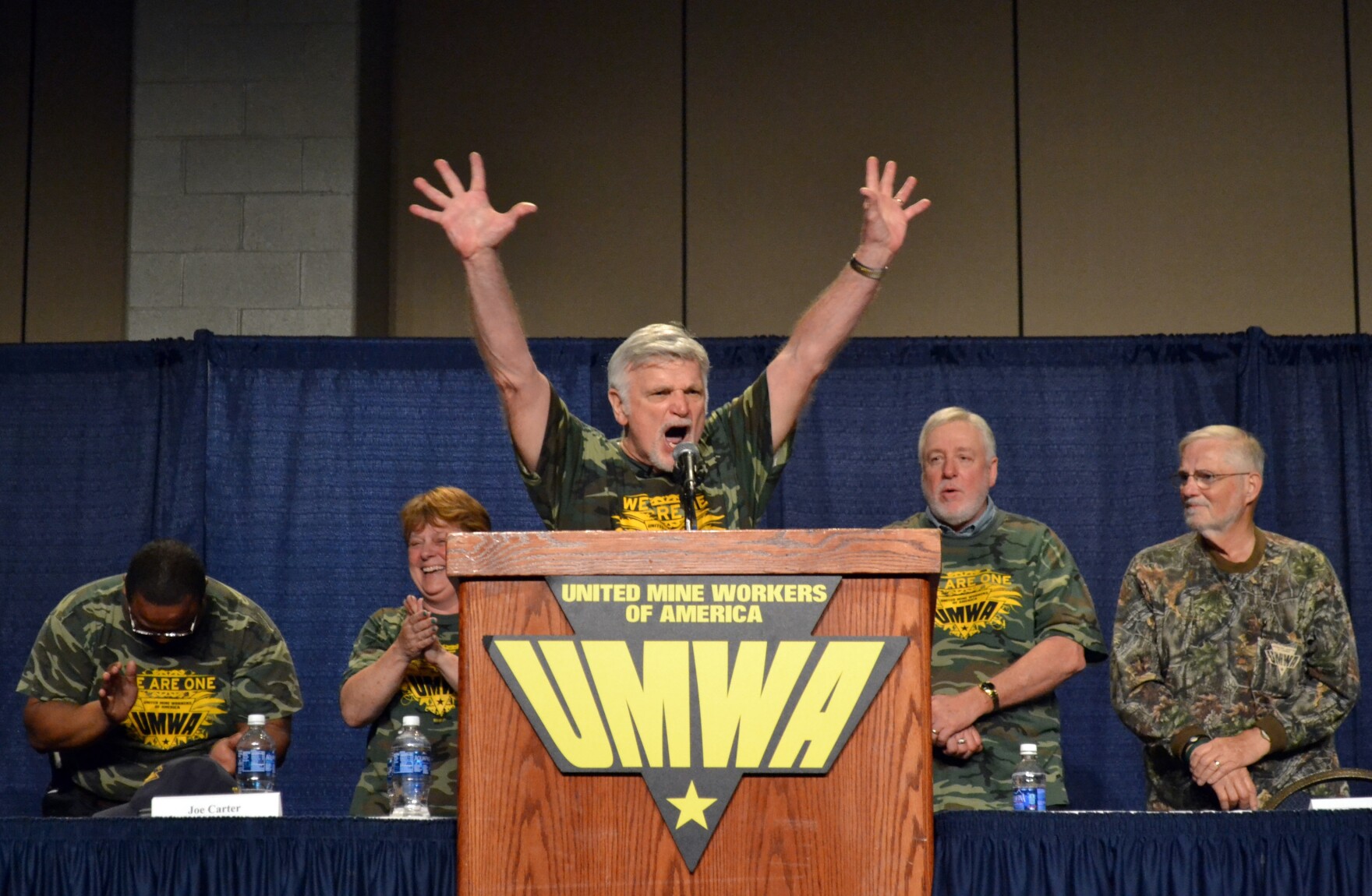

Roberts: Oh, absolutely. There has never been a more dedicated group of people than those retirees who made the trip to Washington, D.C., lobbying for their pensions and health care. I’ve had senators and House members alike tell me, both Republican and Democrats, by the way, that they never saw a more effective group of people coming on Capitol Hill and lobbying with those camouflage shirts that they wore time and time again to Capitol Hill.

They went for about eight bucks a shot, and when you buy them in mass, they out-lobbied people on K Street that had a $10,000 suit on, so yes, those are the most, they are, and they were the most dedicated people that you ever meet. And I’m, I worry about all of the effort that they put into saving their pensions and health care.

Where we stand with that, everywhere you look, there’s been cuts made, and this billionaire, the richest man on earth telling other people who work for a living, well, we don’t need Social Security. And people say, he never said that. And he said, when you say it’s a Ponzi scheme, you don’t have much faith in Social Security. Social Security is something that people depend on. People have paid into. They deserve to keep it and along with their Medicare and this issue of doing away with Medicaid to people who are the poorest people in the country.

The question it really is to me, is, what kind of nation are we? And I think when we do analysis of that, I think we need to keep Social Security, Medicare, Medicaid. I think we need to keep the pensions and health care people have earned in this country. Remember, people work for these benefits, and people pay for these benefits, and they ought to retain them.

Tate: I wanted to ask you about your recent announcement that you’re stepping down later this year. How are you feeling about that?

Roberts: Well, I think the same way most people have been doing something they love for a long time. It’s somewhat mixed emotions, but I’m dealing with reality here, unless I plan on living to 120 now. Is probably the best time to consider retiring. I will miss this job every day, but I also realize that John L. Lewis left here and the union continued to move forward. Mother Jones left the union, and the union continued to move forward.

This union will be fine, because Brian Samson is going to make a great president. I’m proud of the many things that we’ve gotten done here. People talk about this legislation we passed in 2019 for 180,000, probably in that neighborhood, people’s pensions and health care.

I don’t think it’s something that’s been done by anybody else, but back in 1989 during the Pittston strike, the issue on the table in that strike was pensions and health care. They just said they weren’t paying for it anymore, and we ended up winning that strike. And in two years we passed legislation, the first coal act incorporated into the law that 107,000 people would have health care guaranteed by the government.

Then, unbelievably, a few years later, we’re back in the middle of that fight again. So we’ve been fighting here for pensions and health care since I’ve been an officer. Ironically, when I was born in 1946, 15 miles up Cabin Creek Road in a company house, delivered by a company doctor. My dad was on strike for pensions and health care.

Tate: Wow.

Roberts: Yeah, the first 1946 legislation that passed, my dad was striking at that time, and the first day I walked into the district office. It’s an amazing thing. Health care had been cut in July, the first across this country by health retirement funds, and that happened the day I walked in the door in the district. So this has been with me since the day I was born, and I hope that Brian doesn’t have to contend with this anymore, because this is a crowning achievement of the United Mine Workers going all the way back to 1946.

But look, I’m 78 years old. Most people know that I’ve got a form of leukemia that I brought back with me from Vietnam and didn’t know it, and was diagnosed with it about two years ago. I’m in remission now, and I’m thinking, ‘Well, I’m blessed.’ I’ve got my health back and where it should be doing this job as president. For 30 years. I was vice president for 13. I was in vice president district 17 for five and a half years, I worked in a coal mines five and a half years, I was in the army for two years in Vietnam for a year.

I think it’s a career that needs to be in the rearview mirror. More than likely, and most likely, I’ll be available to do anything Brian Samson needs me to do, and I’ll lobby for if he wants me to. I’ll get arrested if he wants me to, I’ll picket if he wants. I’ll do whatever he needs me to do. I’m retiring. I’m not quitting.