Gov. Jim Justice continued to push for tax reform Monday in a roundtable that featured two of the country’s top conservative tax policy influencers.

In his opening remarks the governor drew attention to the crowd size.

“There’s an awful lot of you out there, I hope you don’t have any eggs or rocks,” he said.

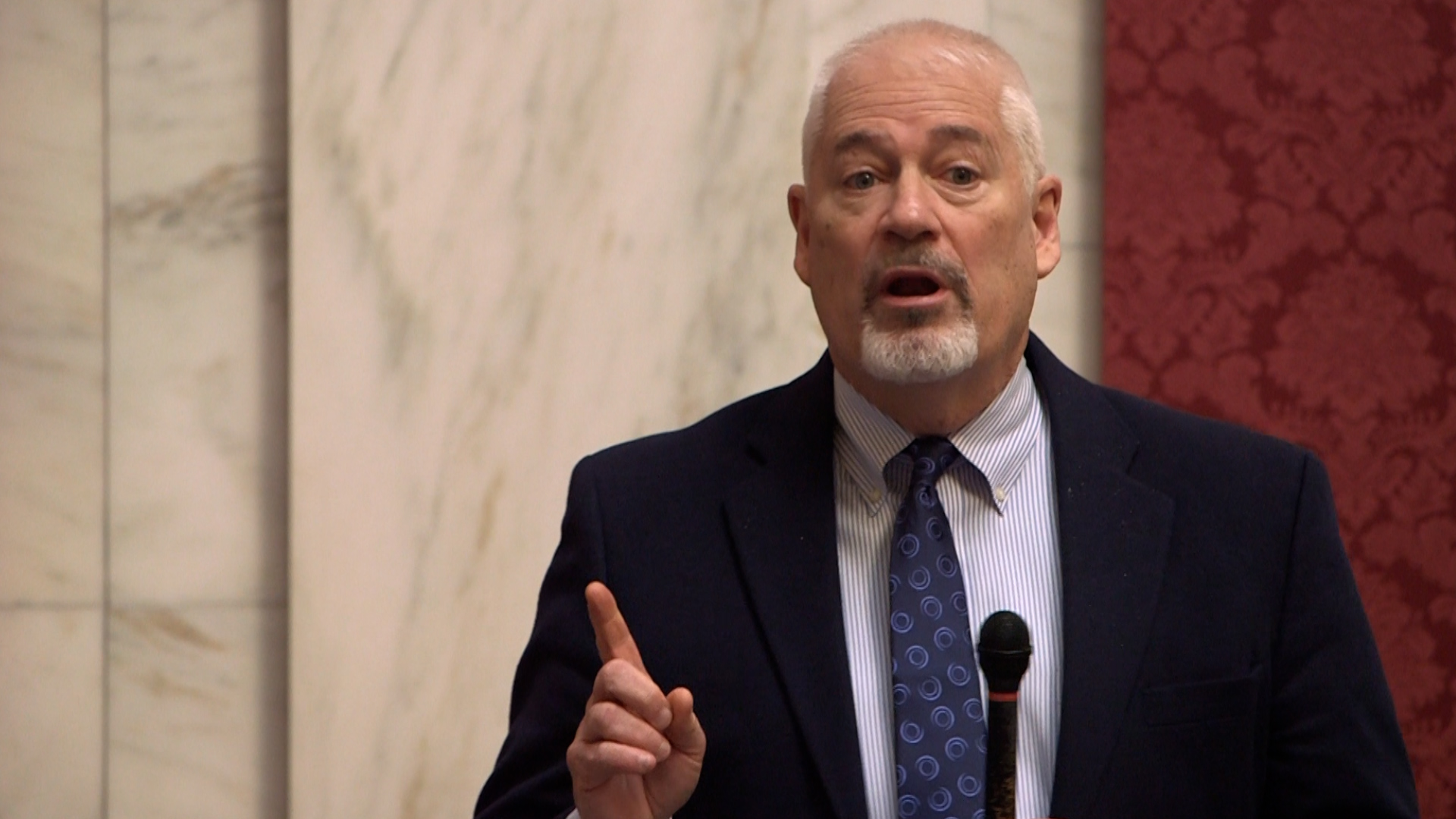

Justice was joined at the West Virginia Culture Center by Grover Norquist, president of Americans for Tax Reform and Stephen Moore with The Heritage Foundation.

The nearly all male roundtable also featured Senate President Craig Blair, R-Berkeley, House Speaker Roger Hanshaw, R-Clay, and local business leaders.

A few of those business stakeholders included Charleston Chick-Fil-A owner Tom Minturn; president of Ashbrooke Express Mart, Joseph Moser; and Kristin Anderson, a former swimming coach and “wife and mother” from the Kanawha Valley area.

“I’ve seen too many friends and family members choose to leave the state for opportunities and so I think anything we can do to make this you know, make our economy competitive, make this a desirable place to live, work and raise a family,” Anderson said. “Once people get here. They won’t leave.”

Justice has been promoting a reduction in the personal income tax since last year. His tax plan, approved by the House at the start of the 2023 legislative session calls for a 50 percent personal income tax cut beginning with a 30 percent phased-in cut starting in June. This would be followed by two 10 percent tax cuts in 2024 and 2025. It includes a $700 million fund to cover a possible financial downturn.

The House of Delegates early in the legislative session passed a bill similar to the governor’s recommendation. The Senate has since passed a separate bill with small reductions as well as tax credits.

Norquist said moving quickly to bring the rates down to zero over time is key. He cited North Carolina, which he said has “taken their income tax rate down dramatically” over the last 12 years.

“There’s not much of a difference between six years and seven years. Get it done, get it done right and bring the rates down to zero over time,” Norquist said. “The most successful states have done it with triggers, where revenue comes in above a planned spending level. So half of that money or two thirds of that increase goes straight into reducing the income tax permanently.”

Norquist described it as a march to zero.

“There are a number of states doing it. West Virginia can be in the lead, acting this year,” he said. “And I just urge you to look towards a flat rate, look toward zero, and make it clear that that’s where you’re going over time so that people making investments deciding to move here decide to stay here know that that’s what’s coming.

Stephen Moore said the state’s economic viability depends on what he called three “critical” factors: the right to work, schools of choice, and zeroing out the income tax.

“That’s an enormous stimulus to the families of West Virginia but also to the economy,” he said.

Both Blair and Hanshaw talked about tax reform under consideration in the legislature. Blair said he was concerned about how going to zero tax income would change the metrics on how the state’s reciprocity agreement with other states works.

Blair is talking about West Virginia’s reciprocal agreements with Kentucky, Maryland, Ohio, Pennsylvania and Virginia. Any West Virginia resident who works in one of those states, must file for a refund from that state if their employer withheld the other state’s income tax.

“We will make it so that the people working in West Virginia will be zero, but they could actually end up paying more taxes than what they currently would have been in the state if the reciprocity agreement goes away.”

“And that reciprocity agreement is real. These other states that need it because the other states around them came up that way and they were able to manage accordingly.”

Dr. Joshua Baker, president of Mount West Community and Technical College in Huntington, told the panel he’s heard from site selectors and companies concerned about “available workforce” as well as about taxes.

“I think we’re in a very interesting time period where people, mostly because of remote work but also because of some socio-political issues that people are looking to relocate and we are on the map,” Baker said. “And the package that we put together, which absolutely includes taxes, is a critical element as they decide where they’re going to move.”

Charleston Chick-Fil-A owner Tom Minturn returned to West Virginia 12 years ago to open up his business which now includes about 250 team members.

“We talk a lot about prosperity, and we do some financial counseling coaching with them to be able to help them but to be able to provide this for them would be amazing,” he said.