The release noted that at the close of the fiscal year, June 30, 2023, at midnight, total collections for the revenue year will come in at approximately $6.5 billion – 10 percent ahead of prior year adjusted collections – marking the first time in state history that final collections for a single year have exceeded $6 billion.

Gov. Jim Justice announced on Friday that West Virginia’s cumulative revenue collections for Fiscal Year 2023 will come in at $1.8 billion over estimate. He said the budget surplus breaks the record for biggest single-year revenue surplus in state history for the second year in a row.

“I’m going to work with the Legislature to take what’s left unappropriated and continue to make wise investments in what we know will bring us more goodness,” Justice said in a press release. “Things like infrastructure, federal matches, and tourism, because the more we tell the world about West Virginia, the more people will want to live, work, and raise their families here.”

Looking at the fiscal 2023 year end numbers, Kelly Allen, the Executive Director of the West Virginia Center on Budget and Policy, called this a manufactured surplus. She said because Justice set revenue estimates artificially low, that essentially capped the size of the budget and left state financial and employment crisis situations unresolved.

“Legislators have to pass a balanced budget,” Allen said. “They have to stick with that top line number that the governor gave them when they passed the budget that had to stay at $4.8 billion, even though we knew more like $6 billion was going to come in. And we’re seeing the results of that with the budget crisis at WVU, with vacancies at our correctional facilities with other crises that are going on. We think of that surplus as a missed opportunity of taxpayer dollars that aren’t getting to where they’re supposed to go, because agencies and other organizations that depend on state dollars haven’t been able to build those into their budgets.”

The release noted that at the close of the fiscal year, June 30, 2023, at midnight, total collections for the revenue year will come in at approximately $6.5 billion – 10 percent ahead of prior year adjusted collections – marking the first time in state history that final collections for a single year have exceeded $6 billion.

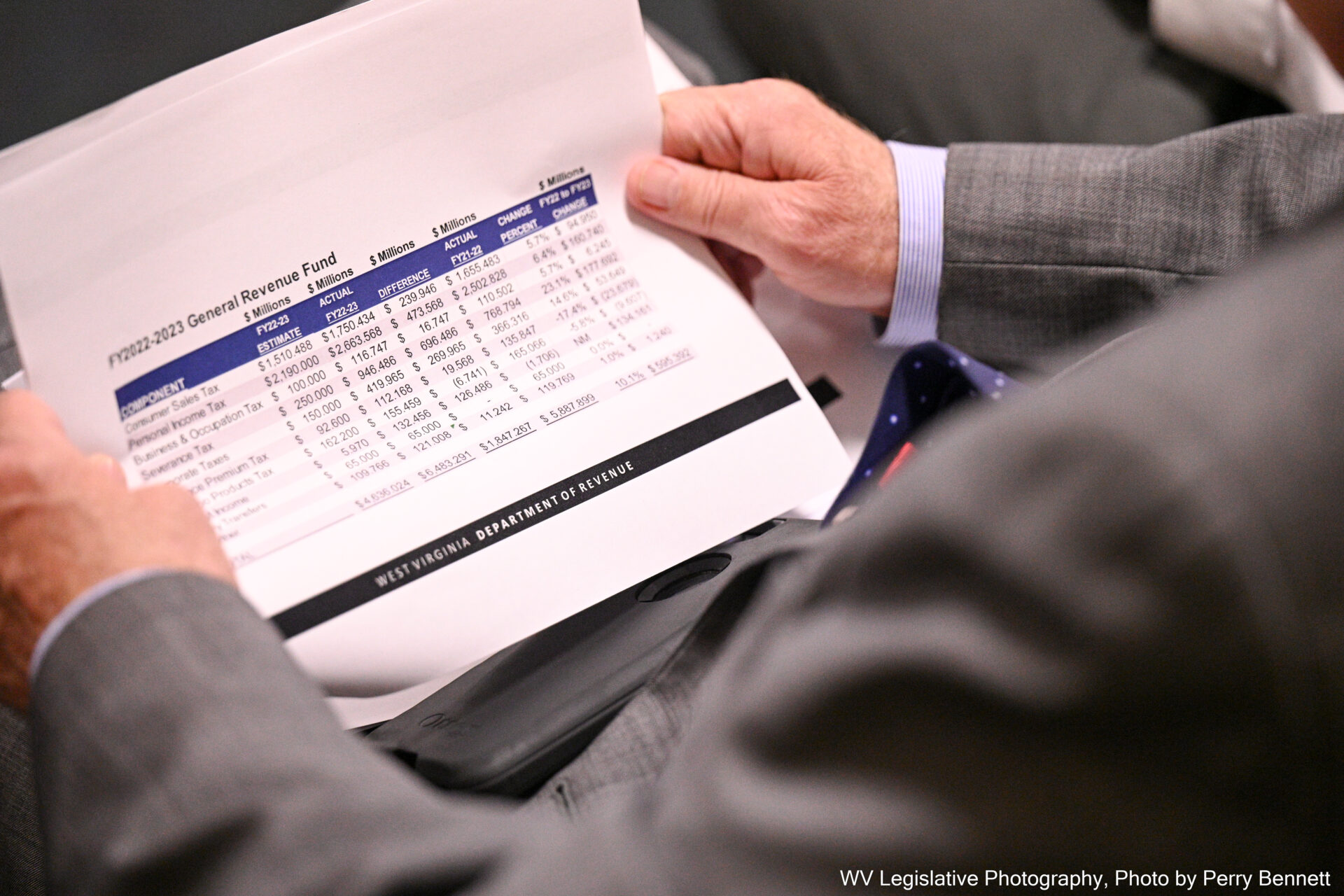

In an income breakdown, the release noted:

- Severance Tax collections set a record of nearly $950 million, a 24% increase from the prior year, with taxes from natural gas accounting for roughly 60% of total collections.

- Corporation Net Income Tax collections grew at 14% and totaled $420 million, eclipsing a record set 15 years ago in 2008.

- Personal Income Tax collections set a new record of $2.66 billion, despite a rate reduction of 21.25% that kicked in after the West Virginia Legislature passed and Gov. Justice signed HB 2526, the largest tax cut in State history.

- Consumer Sales Tax reached an all-time record of $1.75 billion, growing by about 5.7% from last year, and Interest Income Tax Collections reached an all-time record of more than $132.4 million.

Allen said those record collections are skewed because responsible budgeting requires accounting for inflation’s impact on the budget.

“With inflation, the cost of everything goes up,” Allen said. “Things that the state pays for goes up – salaries for state workers, the cost of health insurance and medical costs, utilities. The costs go up every year a little bit just like they do for households. And by holding the budget flat, that means that the agencies and public organizations that rely on state dollars are able to do less and less with the same amount of money because the dollar just doesn’t go as far. It’s a problem for maintaining services, as we’re seeing in these crises and different sectors all over the state. But it also means that taxes that are being paid by all of us aren’t aren’t getting to the public services that we intended for them to pay for.”

The Justice press release added that, by law, a percentage of the year-end surplus must be transferred to the state’s rainy day fund, this year that amount is approximately $231 million. This leaves approximately $454 million unappropriated. June 2023 total collections are expected to come in at approximately $580 million.