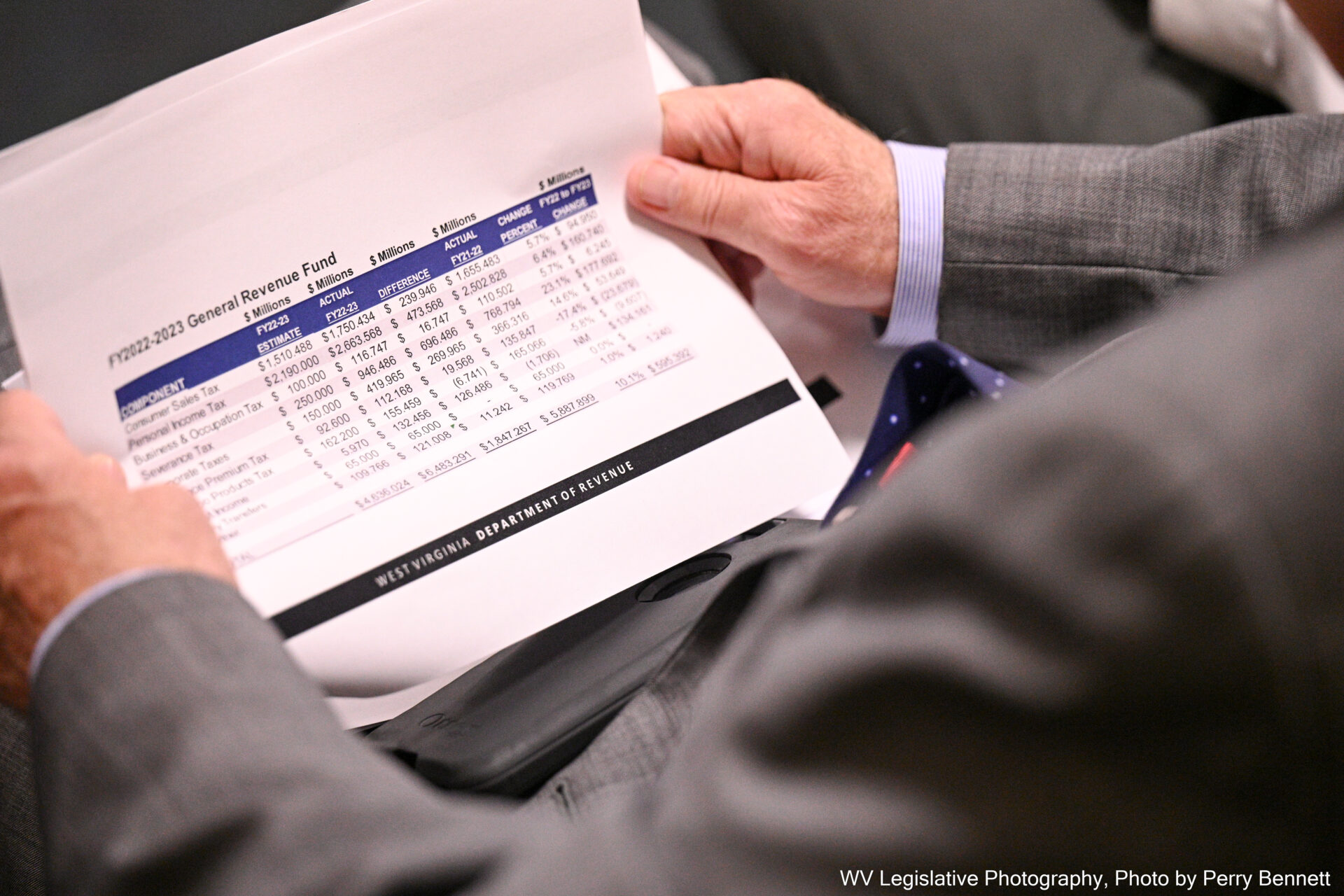

West Virginia’s state revenue is down from last fiscal year by 12 percent — a difference of more than $500 million.

In March 2024, the state collected about $487.4 million. That is nearly $95 million over revenue estimates, but 6 percent lower than what it collected in March 2023.

Sean O’Leary, senior policy analyst with the West Virginia Center on Budget and Policy, attributed the change to personal income tax cuts passed last year.

In 2023, Gov. Jim Justice cut personal income tax in the state by more than 20 percent, the largest tax cut in the state’s history.

Proponents of the cuts saw it as a way for residents to keep more money from their paychecks. But others worried decreasing state funding would make it harder to keep up with infrastructure needs.

O’Leary said that the decrease in state funds has reduced Medicaid and higher education resources in the state.

He also said that a collapse in natural gas prices has further reduced taxable revenue sources for the state.

Still, despite the decrease in income, the state is exceeding revenue estimates by more than $522 million.

Budget estimates are set by the State Budget Office, a staff agency for the governor.

Justice has expressed optimism over the surplus, despite the decrease in revenue and a dip below state estimates in February.

“We’ve shown time and time again that when we put West Virginians first, and prioritize their needs and wants, it propels our rocket ship higher,” Justice said in a Monday press release.