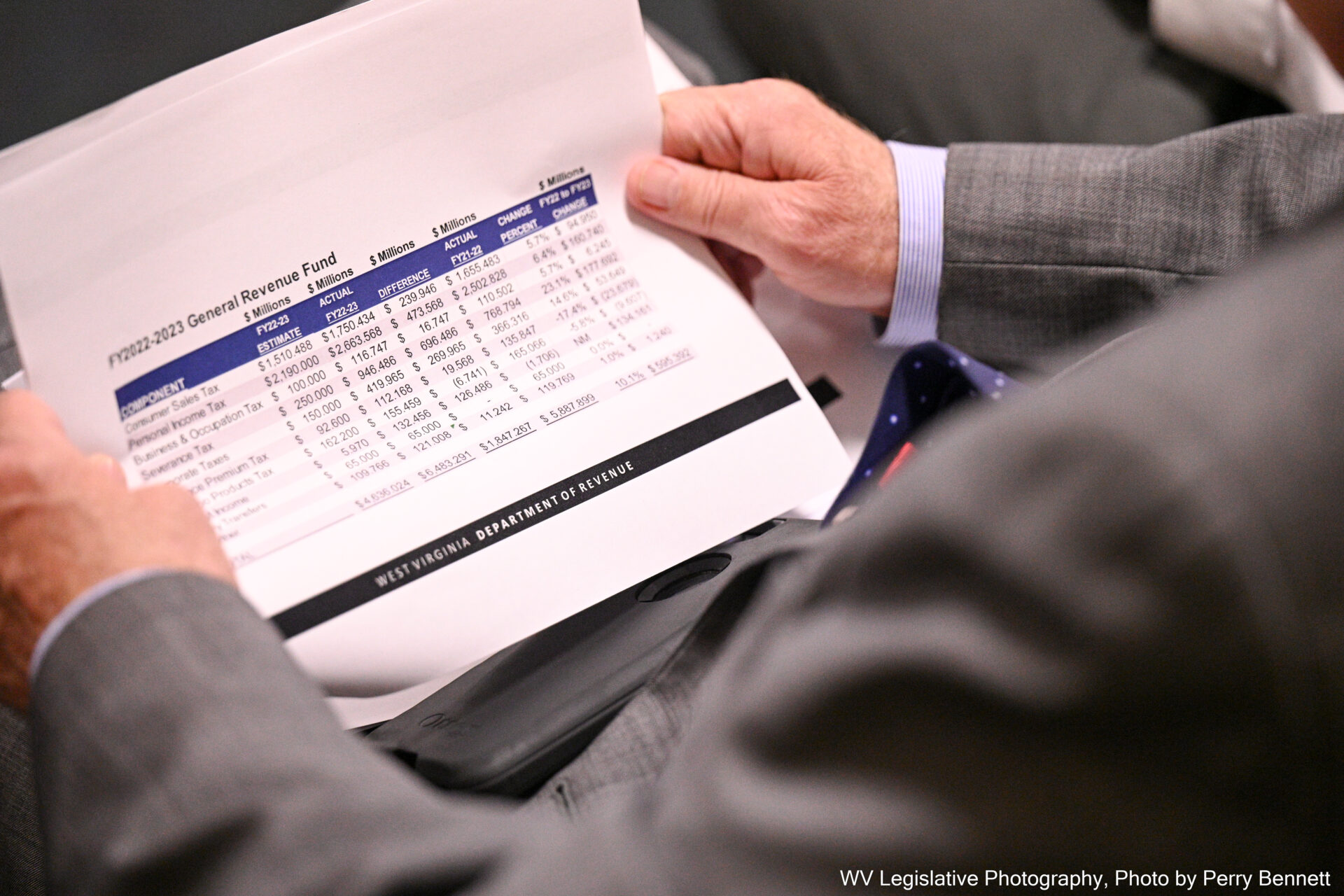

West Virginia’s state revenue for February 2024 fell $30.62 million below official estimates — nearly 10 percent lower than anticipated.

The state revenue is totaled from taxes, fees and service charges. That figure hit just $283.4 million in February.

Despite the shortfall, the state’s revenue remains ahead of projections for fiscal year 2024 as a whole.

Since the start of the 2024 fiscal year in July, the state has collected more than $3.581 billion, which is nearly 14 percent higher than initial projections for the fiscal year.

In a press release Monday, Gov. Jim Justice still expressed optimism for the months ahead.

“While February’s revenue came in slightly below our expectations, it’s important to remember this is due to the timing of certain personal income tax credits,” he said. “Looking ahead, I remain very confident in West Virginia’s long-term financial health.”