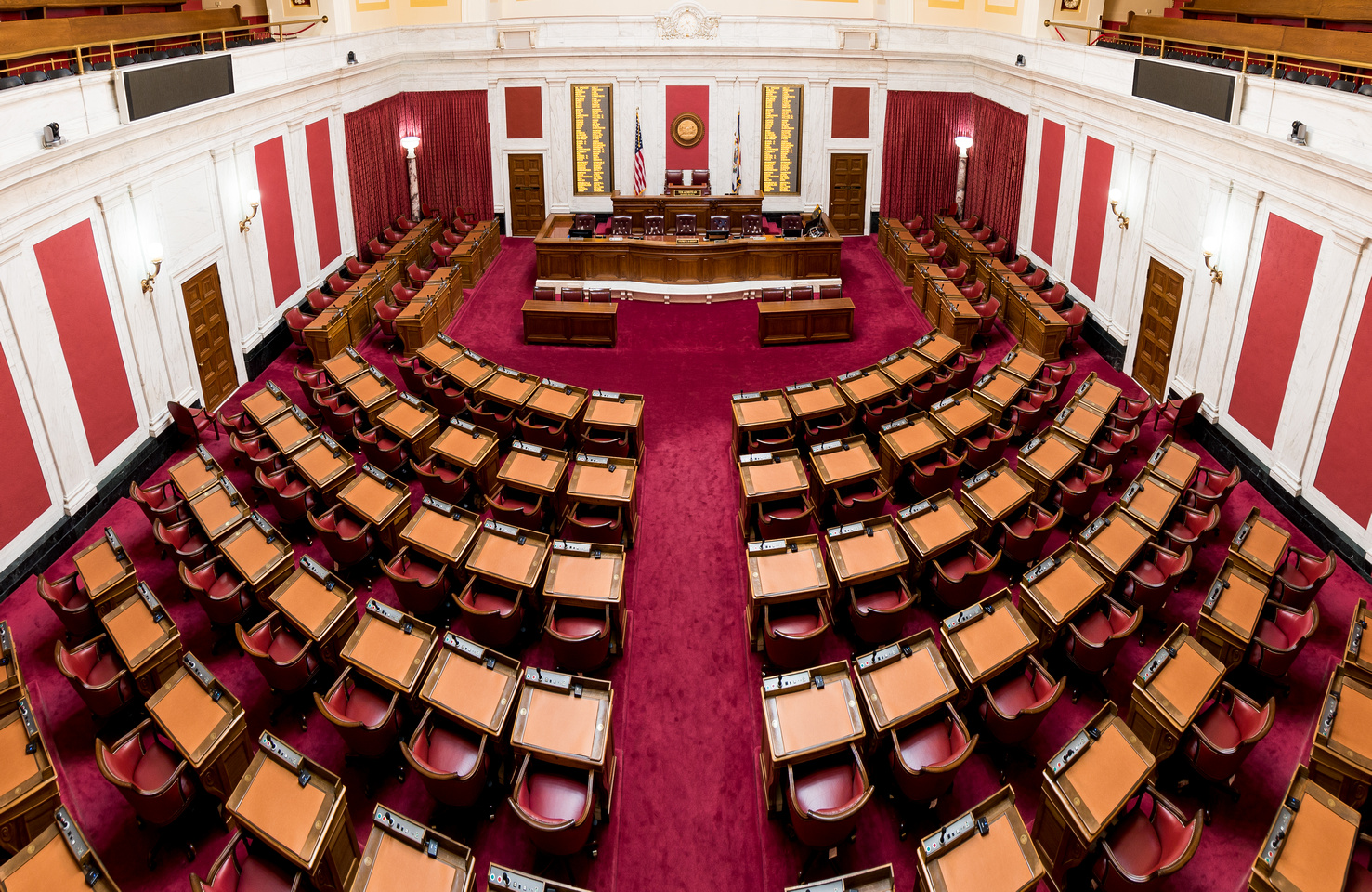

Gov. Jim Justice has issued a proclamation calling for the West Virginia Legislature to convene for a second Special Session of the year starting Monday, Sept 30, 2024. Both chambers will gavel in at 11 a.m.

There are 27 items on the call, including one to pay for costs of the session itself. Most of the remaining 26 items are supplemental funding requests with excess revenue from the 2024 fiscal year. Those funds must be appropriated to state programs or sent to line items like the rainy day fund.

The first five items on the call are of special note.

1. Calls for an additional 5 percent personal income tax reduction over and above the 21.25 percent decrease last year and the triggered 4 percent from this summer that was included in the previous cut.

2. Creates a 50 percent child and dependent care credit against the personal income tax.

3. Allows public charter schools to apply for School Building Authority money.

4. Authorizes the state to work with the United States Nuclear Regulatory Commission to create a system for the control of sources of radiation for the protection of the public.

5. Permit the state to develop a clinical opioid treatment program.

Despite numerous calls to address issues relating to homeschooling, Justice said Friday that would be better left to the regular session which begins in February 2025. Justice will no longer be governor at that time.

Once the session gets underway, bill status may be found here.

Justice released the following statement:

“As I call this Special Session, the goal is clear that we need to help the hardworking people of West Virginia. I’m hopeful that we can get another personal income tax cut across the finish line. I’ve said it time and again: nothing will help our population grow, create new opportunities, and drive economic progress in West Virginia like eliminating our personal income tax. We’re on the right track, but we need to keep pushing forward. The growth and momentum we’ve built during my time as governor is off the charts. It’s truly been a rocketship ride. We’ve also minded the store, and because of that we now have the opportunity to get these things done.

“We also need to do something to help hardworking families afford childcare. Right now, families across the country are struggling with extreme childcare costs, and we can’t sit on the sidelines and watch it happen in West Virginia. We need to step in and help. That’s why I’m again asking for a childcare tax credit to lower costs for families. This will make things a lot better for working families.

“There are additional things to address, such as more money for our schools and our nurses and getting major water, sewer, and infrastructure projects across West Virginia completed.”