Revenue Secretary Dave Hardy said executive branch revenue estimate settings are ingrained in constitutional code.

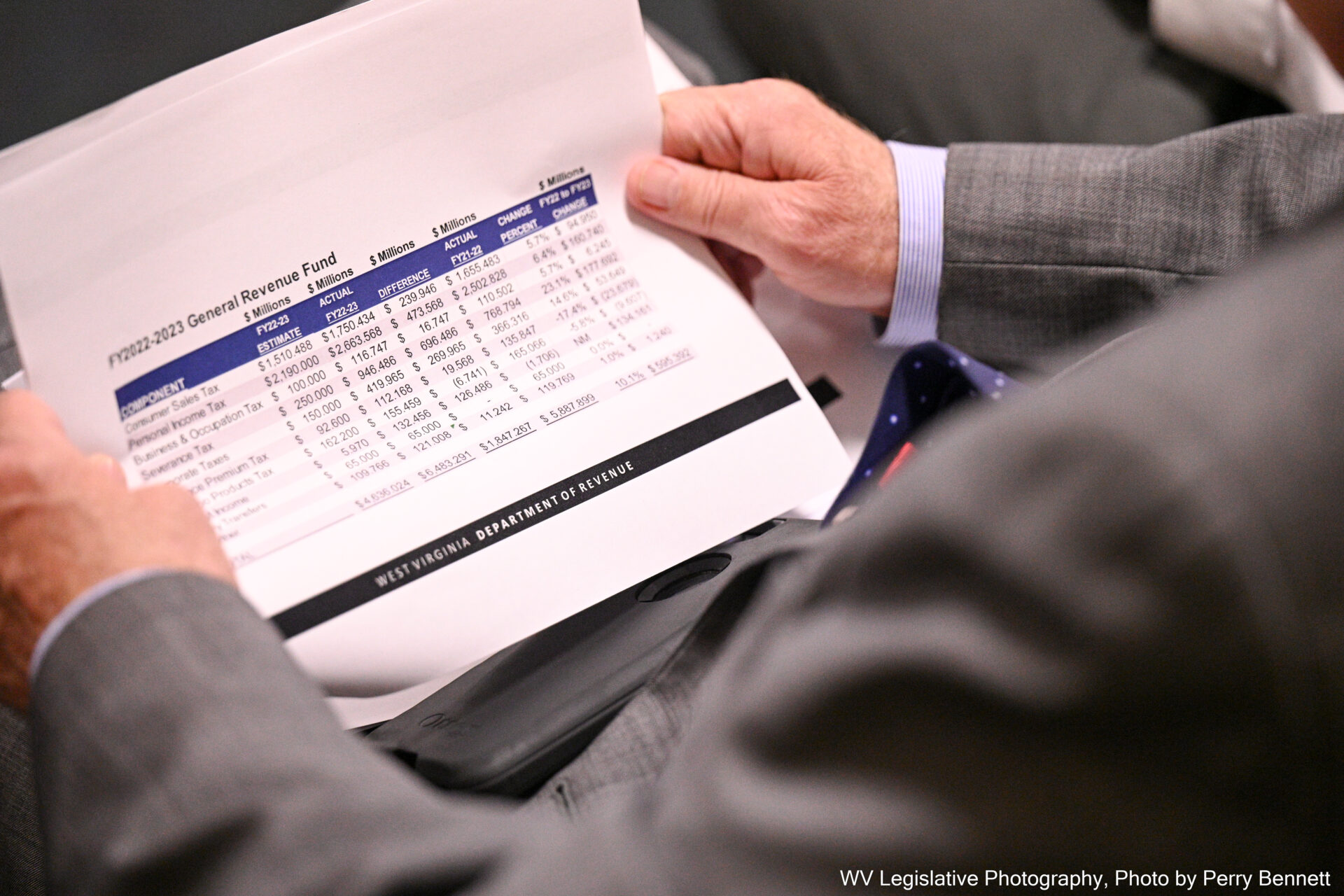

West Virginia’s annual budget is based on revenue estimates that come from the governor’s office. The budget surplus comes from taxes collected above those revenue estimates. How those estimated amounts are determined garners differing points of view.

Sean O’Leary is the senior policy analyst at the West Virginia Center on Budget and Policy. He said when the Justice administration pointed out that this April’s general revenue collection beat the estimate by $319 million, the base budget estimate of $509 million was $284 million below last year’s actual collections of $791 million. O’ Leary called the surplus ”smoke and mirrors.”

“You’d have to assume that the governor and the budget office thought that the economy was going to collapse,” O’Leary said. “So these revenue estimates were set intentionally low in order to keep the budget low, and to generate these large surpluses.”

Revenue Secretary Dave Hardy said executive branch revenue estimate settings are ingrained in constitutional code.

“In 1968, West Virginians voted on a constitutional amendment,” Hardy said. “We call it the modern budget amendment, even though now it’s not so modern. It allows the governor to set the revenue estimates for the state of West Virginia. So every year, our governor sets the revenue estimates and then the legislature can only budget up to the limit that he sets.”

O’Leary said, unlike West Virginia, many states open up their revenue estimate setting process, getting many parties involved.

“When they do revenue estimates, they do a consensus forecast,” O’leary said. “Most other states do this where they have the tax department, someone from the university, some economists and they’ll have the legislature involved as well. And then you get more realistic revenue estimates.”

Gov. Jim Justice said his revenue estimates and budget drafting have all the transparency and outside involvement in the world.

Hardy said the governor presents a budget on the first night of the legislative session. “We literally spend 60 days talking to the legislators and our constituents and stakeholders on whether that’s the proper budget that the governor’s proposed at the back end of this process,” Hardy said.

Responding to the question of possibly setting revenue estimates too low, Justice said he’s a conservative businessman who minds the store by not being frivolous and wasteful.

“We took care of our counties the right way,” Justice said. “We have given significant pay raises four times, and the state is cooking because we didn’t go throwing money away on frivolous projects. But we sure got a bunch of folks out there that we can still help.”

Justice said a priority is stemming the corrections crisis. He wants to allocate pay raises to keep corrections officers on the job without seeking significantly higher paying positions in border states. He has said he wouldn’t call a special legislative session without a plan that has house and senate consensus. When Hardy was asked why corrections pay increase wasn’t put in the budget, he said there is some movement right now.

“There’s a plan that’s being formulated now in consultation with the legislature to meet that head on,” Hardy said. “But it can be done in a very intelligent way and it can be done through our base budget in fiscal year 2024.”

Hardy said, “throwing money at a problem is not the answer, having a plan and thinking it through is what you need to do.”