Your browser doesn't support audio playback.

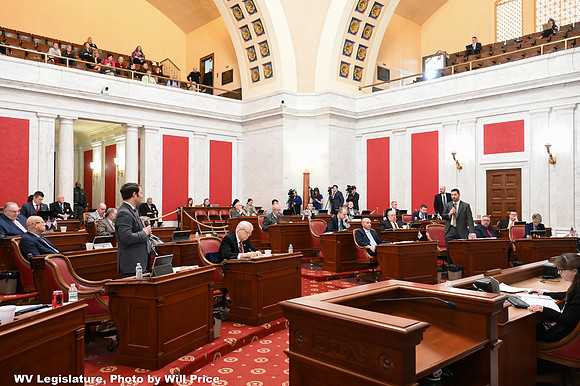

The Senate passed a budget bill on Friday that appropriates $21,162,516,354 in anticipated revenue for the state’s fiscal year beginning July 1.

“The proposed budget includes a revised revenue estimate that contemplates a 10% personal income tax reduction, 3% average pay raise for state employees, $35.1 million in additional funding for PEIA, a fully funded higher education funding formula, fully-funded Medicaid program, funding for the arts is restored, and I hope, Mr. President, the Hope Scholarship is pre-funded,” said Sen. Jason Barrett, R-Berkeley and Finance Committee chairman. The budget, he said, is $386 million higher than last year’s.

Sen. Joey Garcia, D-Marion, was concerned about pending bills not reflected in the budget, including funds for foster care, child care and education.

“At this point, are those bills all dead?” Garcia asked.

“No, Senator. In fact, the pay raise bill that we, as you mentioned, we have not passed yet, that raise is built into this budget,” Barrett said.

Barrett said the point of passing a budget bill with more than 20 days left in the legislative session is to try to secure a cut in personal income taxes and to give time for those discussions to take place in conjunction with members of the House of Delegates, who passed their own budget bill out of committee on Thursday.

“All those things, I think, are still on the table,” Barrett said.

Sen. Mike Woelfel, D-Cabell, opposed allocating $300 million to school vouchers.

“We’ve heard Hancock County can’t pay their teachers next week. Our school boards are barely hanging on. I think our priorities are mixed up,” Woelfel said.

As for the 10% tax cut reflected in the budget and partially offset by a tax hike on vaping products? Woelfel opposed that, too – pointing out that it means about $5 a paycheck, a nice cup of coffee, for average families, but far more for high income political donors.

In a state where one-third of the citizens are on Medicaid, there are plenty of places for the tax funds to go, he said. “The future of health care in our state scares me. SNAP (Supplemental Nutrition Assistance Program) has been cut. A lot of folks are going to go hungry.”

“I think we’ve underfunded CPS (Child Protective Services). I’ve seen people hold up pictures in this place of children, dead children. We owe them an obligation. Tax cuts for the high earners, in my view, is not the priority that this Senate should embrace,” Woelfel said.

Both the budget and the 10% tax cut passed the Senate and will need to be reconciled with the final version from the House of Delegates. The lower chamber’s version does not include a tax cut at all.