West Virginia’s state administrators note that this month’s state budget numbers show the personal income tax cut is not hurting but helping revenue collections.

With revenue amounts for July and August prompting administrative concern, July being about $7 million, Gov. Jim Justice said the September numbers were really good news.

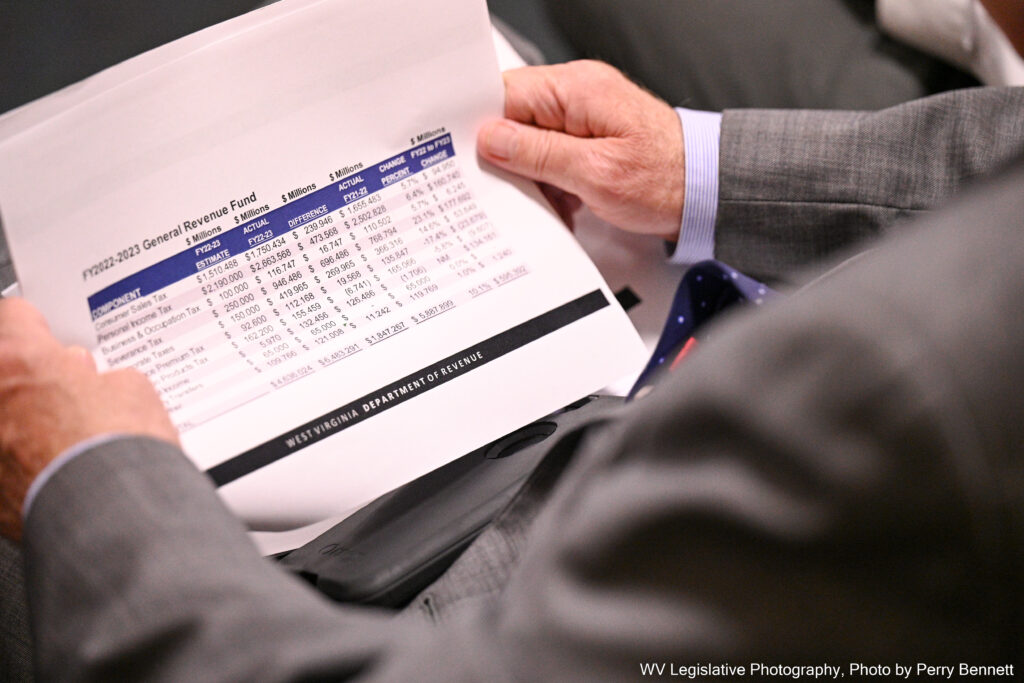

In a Justice administration media briefing Friday afternoon, Revenue Secretary Dave Hardy said September revenues were $210 million above the estimated budget.

Hardy said even with the 21.25 percent personal income tax cut that passed earlier this year, the state is breaking even with income tax collections compared to where it was a year ago.

“That means that we have grown our personal income tax income about 20 percent,” Hardy said. “That’s the story for September, that the state income taxes and our incomes are growing to show that type of revenue growth in such a quick way.”

Hardy said September corporate net income tax collections were $54 million above estimate, growing by 2.2 percent compared to a year ago.

He also said the consumer sales tax was $11.2 million above estimate for September, almost 10 percent above where it was for September 2022.

Independent budget analysts have repeatedly said the Justice administration sets its monthly revenue estimates artificially low.