The West Virginia Chamber of Commerce has thrown its support behind Gov. Jim Justice’s proposed Commercial Activities Tax, or CAT tax.

The 0.045 percent tax would create $45 million a year in new tax revenues for the state.

In a press release from the Governor’s Office, Chamber President Steve Roberts called the tax the “least painful thing” West Virginia businesses can do to contribute to the state.

“The business community recognizes that education and good health are essential to the future success of our state,” Roberts said. “Vital health and education programs are on the line, and if participation from business can save those programs our members want to be part of the solution.”

“It’s time to solve this budget crisis and give West Virginia businesses stability and predictability,” Roberts said.

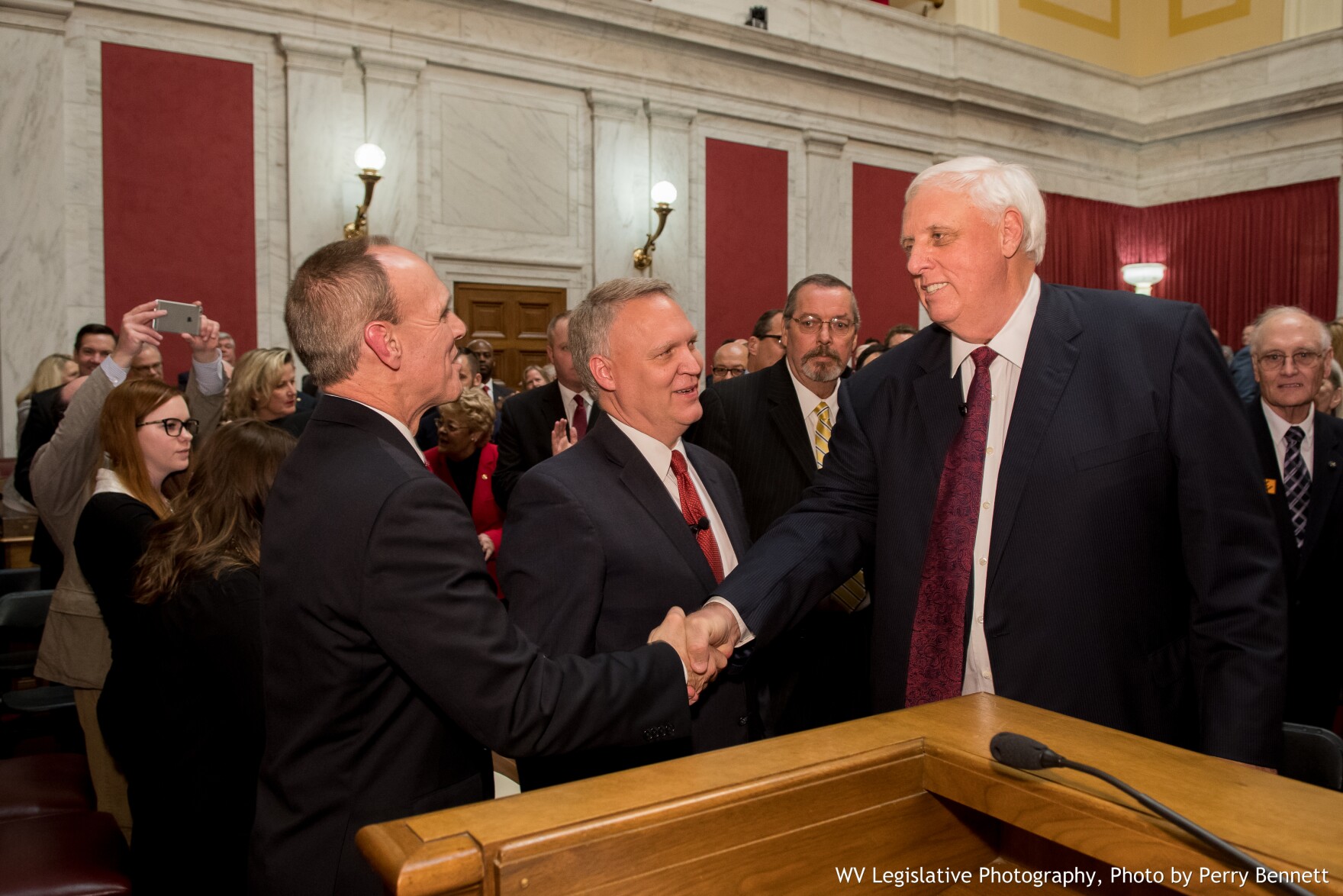

In a press conference Thursday, Justice said budget negotiations between his office and House Republican leaders had broken down over $45 million the governor believes are needed in new revenues.